Skip to content

Blog

Apr 17, 2024

Who is Winning in the Race for GenAI Weaponization—Fraudsters or Fraud Teams?

Read More

Blog

Apr 05, 2024

3 Takeaways from MRC Vegas & Navigating the Evolving eCommerce Landscape

Read More

Customer Story

Mar 22, 2024

How NeuroID Saves Elevate $1-2M a Year Through Accurate Fraud Detection and Operational Efficiency Improvements

Read More

Blog

Mar 15, 2024

Our Experts and FinTech Veterans Dispute Real-Time Money Movement’s Fraud Myths

Read More

Fact Sheet

Mar 14, 2024

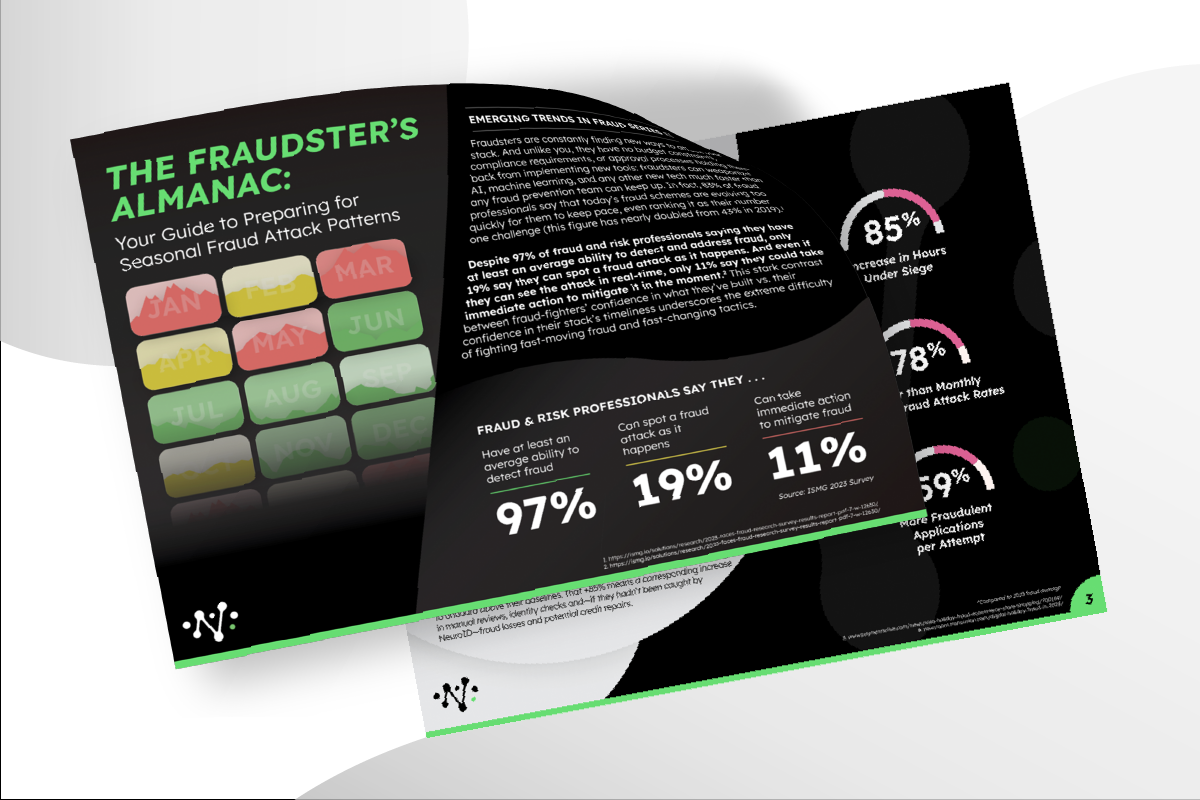

Spring Blooms Bring

Fraud Booms

Read More

Blog

Mar 07, 2024

There’s a Huge Fraud Spike Coming. Are you Ready?

Read More

Blog

Feb 26, 2024

How GenAI is Making Fraud Bots More Dangerous (And What You Can Do About it)

Read More

Blog

Feb 23, 2024

3 Reasons NeuroID is a Must-See at Fintech Meetup

Read More

Blog

Feb 15, 2024

Industry Experts’ 3 Keys to Seamless & Secure Cross-Border Real-Time Payments

Read More